Case study

Selina Advance

Sales Force to fully custom platform for mortgage company.

5,000

Scaled case volume by 300%, handling 5,000+ cases per month

25%

Reduced underwriting errors by 25%, improving accuracy

$150M

Platform optimization directly contributed to closing a $150M Series B round

Team

Delivery manager, technical manager, lead designer, lead developer

What we did

Design

Custom Code

Deliverables

Website

App

Duration

24 weeks

Tech stack

Next j.s, Sanity, AWS.

Selina Advance is a financial service that provides flexible credit lines and loans secured against property in the UK. Currently scaling to become a $100M company, it allows homeowners to access funds based on their property equity, offering a more affordable alternative to traditional unsecured loans or credit.

Problem statement

Selina Advance’s existing Salesforce-based underwriting platform was creating a bottleneck for the underwriting department. A clunky user-experience, an inability to handle complex workflow and poor interoperability with third party tooling limited the department’s ability to reach KPIs that were crucial for it to close its Series B funding round.

Hypothesis

To accelerate case processing for underwriters, Rise needs to deliver a platform optimising the UX for established workflows while simultaneously enabling high levels of customisation through modularity to cater for third party integrations.

Solution

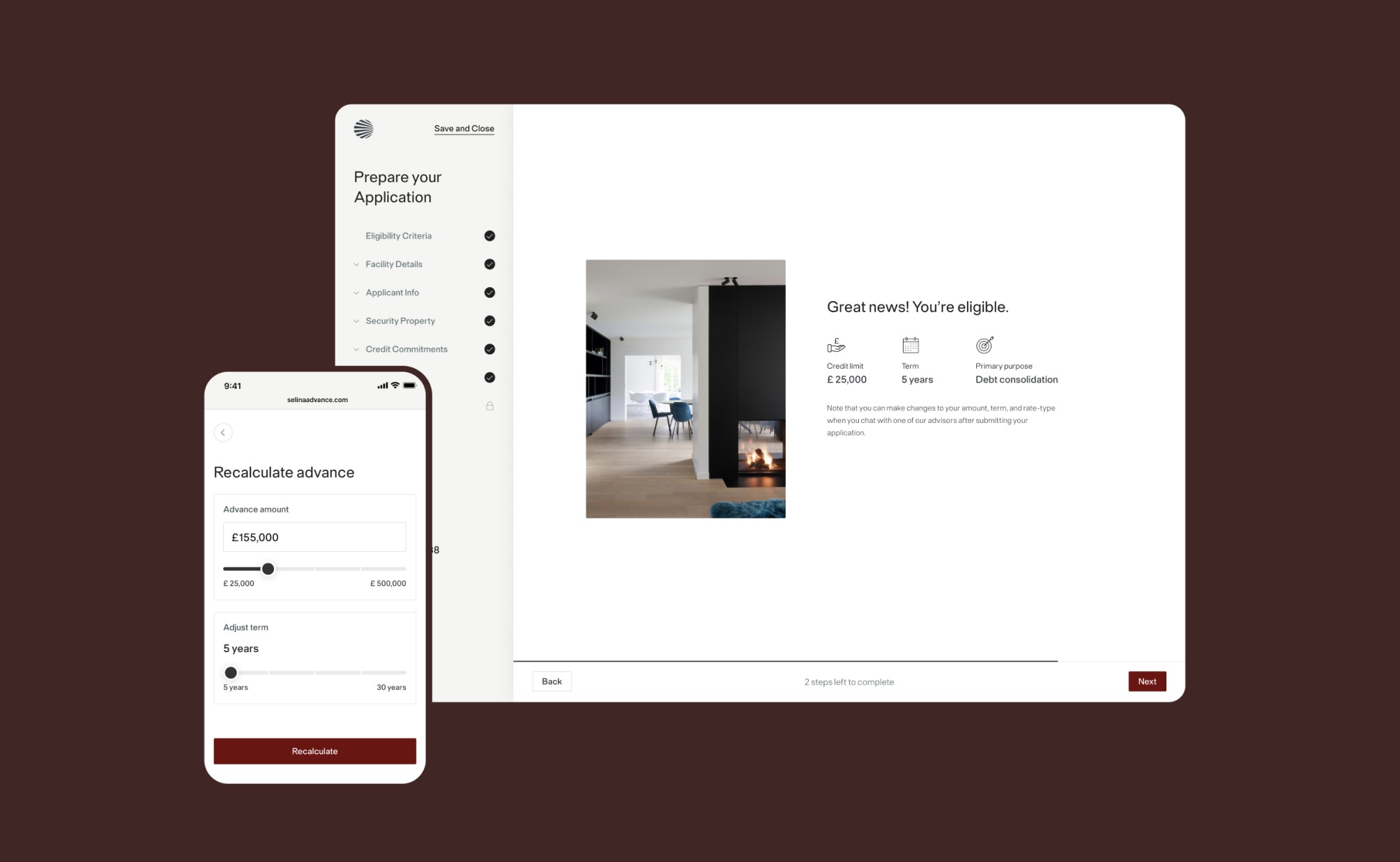

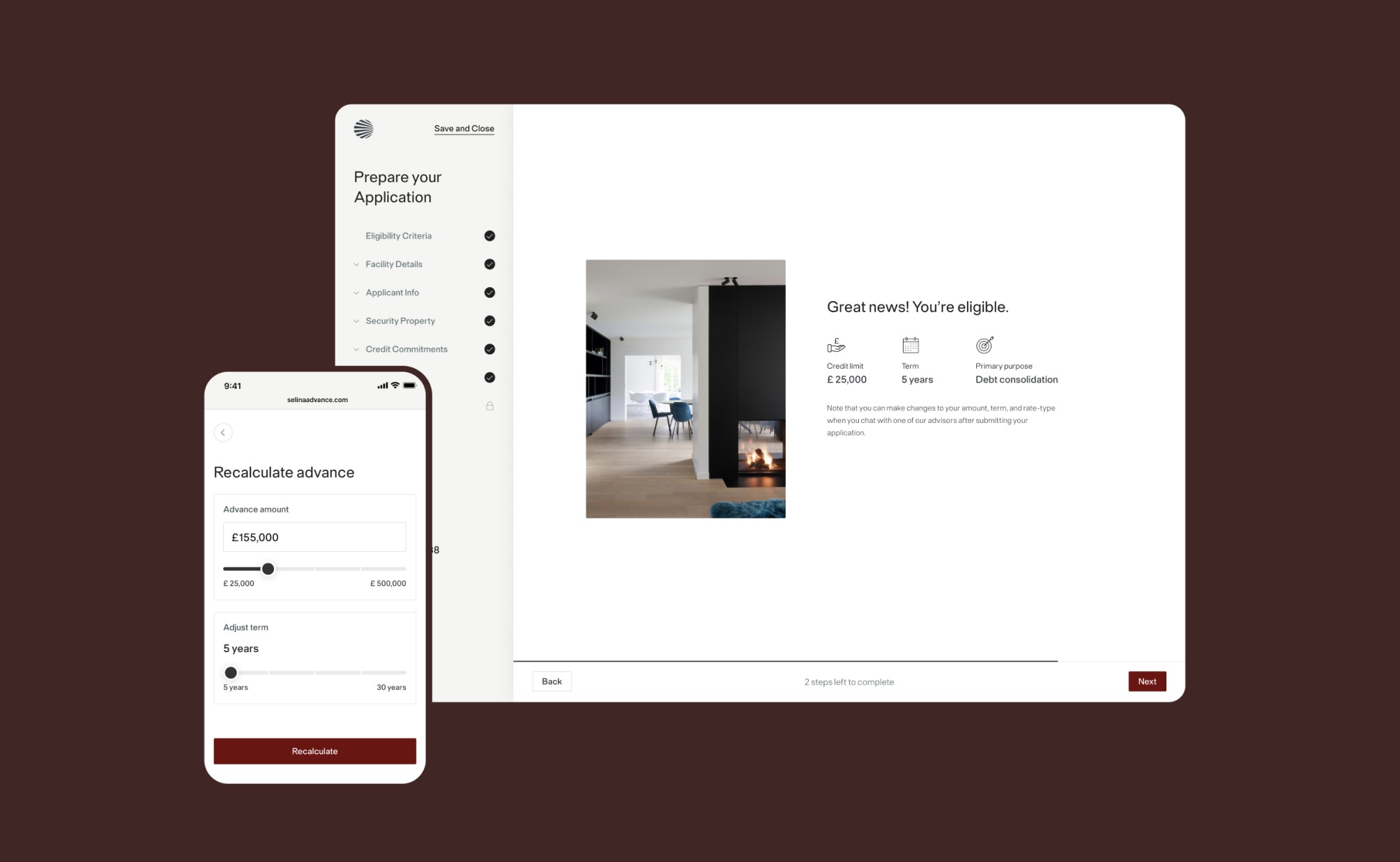

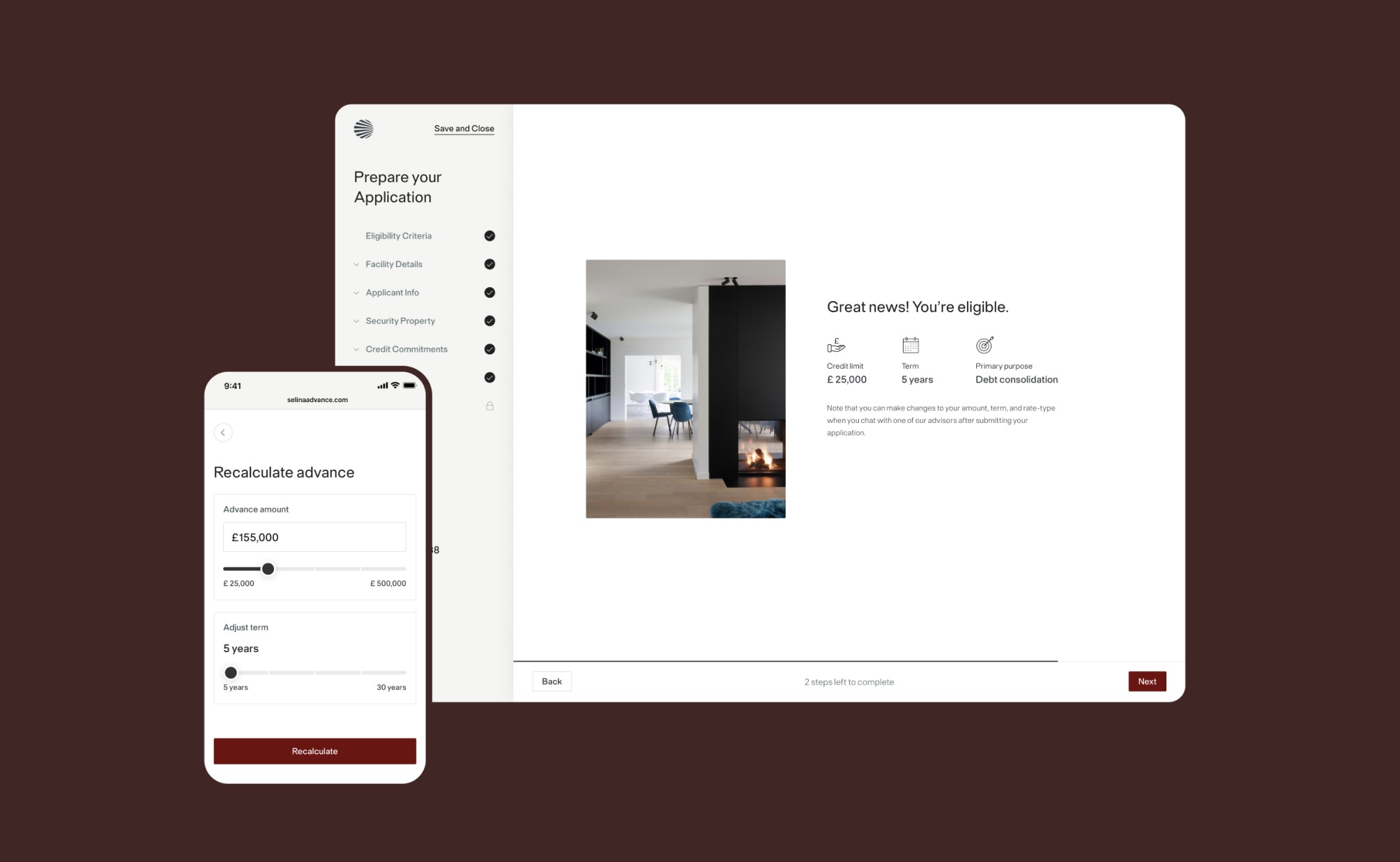

Rise worked with the in-house product team to map all established workflows and understand company data model structures to simplify future API integrations.

Rise mirrored the internal underwriting teams to find points points.

Figma prototypes were used heavily to test new ideas and get buy-in from internal stakeholders.

Rise delivered high-fidelity designs for an end-to-end custom underwriting platform that enabled Seline to scale case processing, enabling them to close a $150M Series B.

As part of the delivery, Rise established continuous data collection and feedback processes, ensuring Selina’s tools could adapt with evolving business needs.

Selina Advance is a financial service that provides flexible credit lines and loans secured against property in the UK. Currently scaling to become a $100M company, it allows homeowners to access funds based on their property equity, offering a more affordable alternative to traditional unsecured loans or credit.

Problem statement

Selina Advance’s existing Salesforce-based underwriting platform was creating a bottleneck for the underwriting department. A clunky user-experience, an inability to handle complex workflow and poor interoperability with third party tooling limited the department’s ability to reach KPIs that were crucial for it to close its Series B funding round.

Hypothesis

To accelerate case processing for underwriters, Rise needs to deliver a platform optimising the UX for established workflows while simultaneously enabling high levels of customisation through modularity to cater for third party integrations.

Solution

Rise worked with the in-house product team to map all established workflows and understand company data model structures to simplify future API integrations.

Rise mirrored the internal underwriting teams to find points points.

Figma prototypes were used heavily to test new ideas and get buy-in from internal stakeholders.

Rise delivered high-fidelity designs for an end-to-end custom underwriting platform that enabled Seline to scale case processing, enabling them to close a $150M Series B.

As part of the delivery, Rise established continuous data collection and feedback processes, ensuring Selina’s tools could adapt with evolving business needs.

Selina Advance is a financial service that provides flexible credit lines and loans secured against property in the UK. Currently scaling to become a $100M company, it allows homeowners to access funds based on their property equity, offering a more affordable alternative to traditional unsecured loans or credit.

Problem statement

Selina Advance’s existing Salesforce-based underwriting platform was creating a bottleneck for the underwriting department. A clunky user-experience, an inability to handle complex workflow and poor interoperability with third party tooling limited the department’s ability to reach KPIs that were crucial for it to close its Series B funding round.

Hypothesis

To accelerate case processing for underwriters, Rise needs to deliver a platform optimising the UX for established workflows while simultaneously enabling high levels of customisation through modularity to cater for third party integrations.

Solution

Rise worked with the in-house product team to map all established workflows and understand company data model structures to simplify future API integrations.

Rise mirrored the internal underwriting teams to find points points.

Figma prototypes were used heavily to test new ideas and get buy-in from internal stakeholders.

Rise delivered high-fidelity designs for an end-to-end custom underwriting platform that enabled Seline to scale case processing, enabling them to close a $150M Series B.

As part of the delivery, Rise established continuous data collection and feedback processes, ensuring Selina’s tools could adapt with evolving business needs.

Selina Advance is a financial service that provides flexible credit lines and loans secured against property in the UK. Currently scaling to become a $100M company, it allows homeowners to access funds based on their property equity, offering a more affordable alternative to traditional unsecured loans or credit.

Problem statement

Selina Advance’s existing Salesforce-based underwriting platform was creating a bottleneck for the underwriting department. A clunky user-experience, an inability to handle complex workflow and poor interoperability with third party tooling limited the department’s ability to reach KPIs that were crucial for it to close its Series B funding round.

Hypothesis

To accelerate case processing for underwriters, Rise needs to deliver a platform optimising the UX for established workflows while simultaneously enabling high levels of customisation through modularity to cater for third party integrations.

Solution

Rise worked with the in-house product team to map all established workflows and understand company data model structures to simplify future API integrations.

Rise mirrored the internal underwriting teams to find points points.

Figma prototypes were used heavily to test new ideas and get buy-in from internal stakeholders.

Rise delivered high-fidelity designs for an end-to-end custom underwriting platform that enabled Seline to scale case processing, enabling them to close a $150M Series B.

As part of the delivery, Rise established continuous data collection and feedback processes, ensuring Selina’s tools could adapt with evolving business needs.

Selina Advance is a financial service that provides flexible credit lines and loans secured against property in the UK. Currently scaling to become a $100M company, it allows homeowners to access funds based on their property equity, offering a more affordable alternative to traditional unsecured loans or credit.

Problem statement

Selina Advance’s existing Salesforce-based underwriting platform was creating a bottleneck for the underwriting department. A clunky user-experience, an inability to handle complex workflow and poor interoperability with third party tooling limited the department’s ability to reach KPIs that were crucial for it to close its Series B funding round.

Hypothesis

To accelerate case processing for underwriters, Rise needs to deliver a platform optimising the UX for established workflows while simultaneously enabling high levels of customisation through modularity to cater for third party integrations.

Solution

Rise worked with the in-house product team to map all established workflows and understand company data model structures to simplify future API integrations.

Rise mirrored the internal underwriting teams to find points points.

Figma prototypes were used heavily to test new ideas and get buy-in from internal stakeholders.

Rise delivered high-fidelity designs for an end-to-end custom underwriting platform that enabled Seline to scale case processing, enabling them to close a $150M Series B.

As part of the delivery, Rise established continuous data collection and feedback processes, ensuring Selina’s tools could adapt with evolving business needs.

Read the next case study

We took the real estate business’ website to the next level.

Grow your bottom line, not your payroll.

Replace three hires with one subscription.

Replace three hires with one subscription.

Replace three hires with one subscription.

Replace three hires with one subscription.

Replace three hires with one subscription.

Trusted by founders, agencies and scaleups worldwide

Let's go

Add your details below so we can prepare for our discovery call with an expert.

Copyright Rise 2025. Designed using Rise.

Cookies

Privacy

Your AI Partners

Rise Lisbon

Mercado de Ribeira

Av. 24 de Julho 1o andar

1200-479 Lisboa

Rise Amsterdam

Herengracht 124-128,

1015 BT Amsterdam,

Netherlands

Your AI Partners

Rise Lisbon

Mercado de Ribeira

Av. 24 de Julho 1o andar

1200-479 Lisboa

Rise Amsterdam

Herengracht 124-128,

1015 BT Amsterdam,

Netherlands

Your AI Partners

Rise Lisbon

Mercado de Ribeira

Av. 24 de Julho 1o andar

1200-479 Lisboa

Rise Amsterdam

Herengracht 124-128,

1015 BT Amsterdam,

Netherlands

Your AI Partners

Rise Lisbon

Mercado de Ribeira

Av. 24 de Julho 1o andar

1200-479 Lisboa

Rise Amsterdam

Herengracht 124-128,

1015 BT Amsterdam,

Netherlands

Your AI Partners

Rise Lisbon

Mercado de Ribeira

Av. 24 de Julho 1o andar

1200-479 Lisboa

Rise Amsterdam

Herengracht 124-128,

1015 BT Amsterdam,

Netherlands

Elevate Your

Execution

Speak to one of our experts about your project—book a call today.

Elevate Your

Execution

Speak to one of our experts about your project—book a call today.

Elevate Your

Execution

Speak to one of our experts about your project—book a call today.

Elevate Your

Execution

Speak to one of our experts about your project—book a call today.

Elevate Your

Execution

Speak to one of our experts about your project—book a call today.